An experiment of InternetU.org's Business School

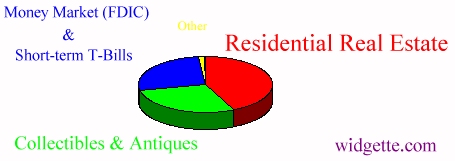

The accompanying chart shows how our investment pie is sliced up.

Our main investment vehicles, listed largest to smallest, are:

Over the last year, we created a "zero risk" stock portfolio. During that time, we also started liquidating all of our investment dollars from the stock market. At this time, we suggest the only funds in the stock market should be purely for gambling (and, we don't recommend gambling.)

We anticipate our asset allocation to continue to shift over the next year as the U.S. Dollar comes under pressure.